Planning To Sell Your House in 2025? Start Prepping Now

If your goal is to sell your house in 2025, now’s the time to start prepping. Even though it might seem like there’s plenty of time between now and the new year, you should get a head start on any updates or repairs you want to make now. As Danielle Hale, Chief Economist at Realtor.com, says:

“ . . . now is the time to start thinking about what you need for your next home and then taking those steps to prepare to list . . . We have survey data that says 47 percent of sellers are taking longer than a month to get their home ready to sell, so getting them to start that process early can mean more flexibility.”

By starting your prep work early, you’ll give yourself plenty of time to get your house market-ready by the end of the year. But be sure to partner with a great agent before you get started, so you have expert insight into what repairs are worth it based on your local market.

Why Starting Early Is Key if You Are Planning To Sell Your House in 2025?

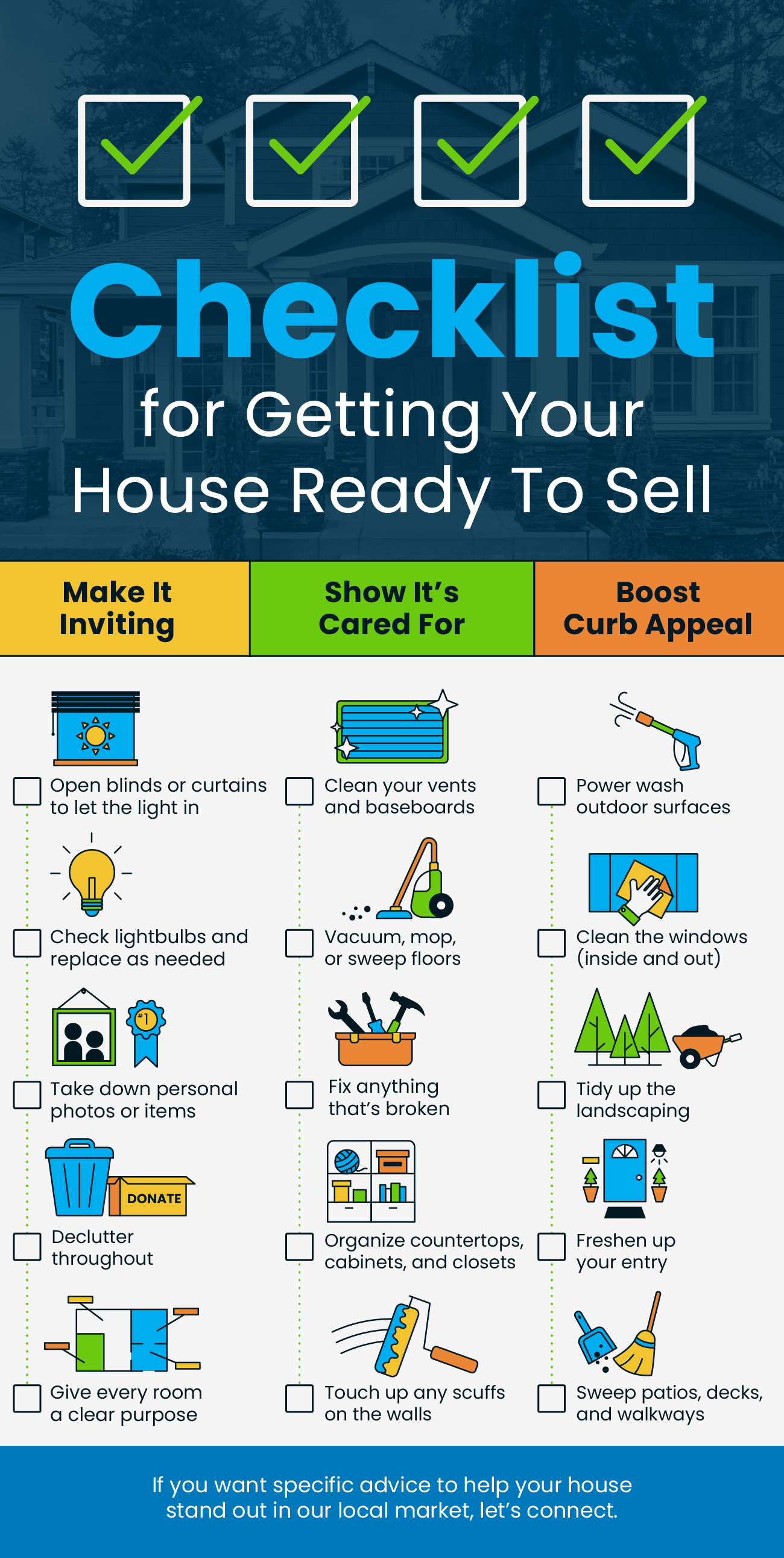

To get the best price and sell quickly, it’s important that your home looks its best. And that means it’s up to you to make the necessary repairs, declutter, and even consider updates that could add value as part of getting your house ready to list.

By starting now, you can tackle things one task at a time. Whether it’s fixing that leaky faucet, refreshing your landscaping, or painting a room, getting an early start gives you the flexibility to do the job right and with as little stress as possible. Because, if you wait to knock items off your list later on, they could quickly stack up and get overwhelming. As Realtor.com explains:

“There are some important repairs to make before selling a house, so don’t be in too much of a hurry to get your home listed … if you move too fast, buyers see right through the fact that you skipped important home renovations. And this . . . might end up costing you time and money.”

What Should You Focus On?

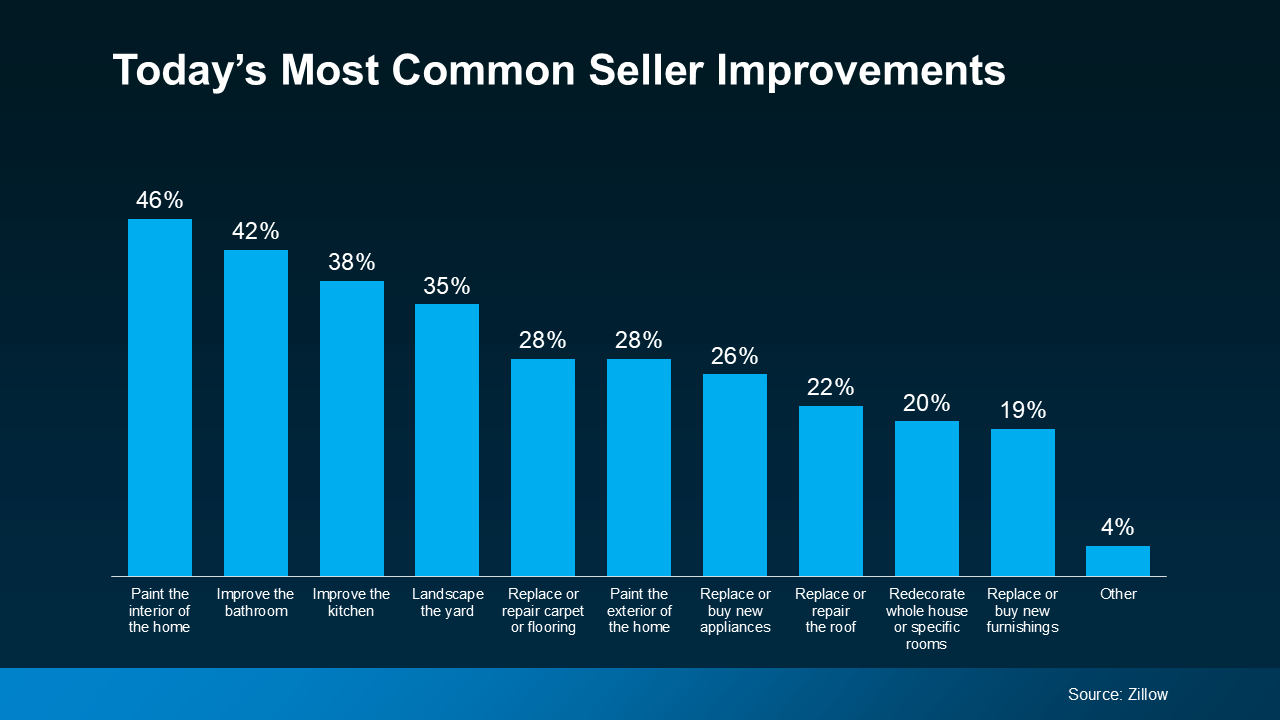

Feeling motivated to start chipping away at that to-do list, but not sure where to start? Here’s a look at the most common improvements other sellers are making today (see graph below):

The Importance of Working with a Local Agent

The Importance of Working with a Local Agent

And while that data gives you a starting point, it shouldn’t be seen as a comprehensive list. What buyers want in your area may be different, and only a local agent will have this in-depth understanding.

For example, if homes in your area are selling quickly with updated kitchens, your agent might suggest focusing on minor kitchen improvements rather than spending money on other areas that won’t offer as much return. They’ll also help you figure out if tackling larger projects, such as replacing your roof or upgrading your HVAC system, is worth it based on other recently sold homes. As Point says:

“Not all renovations are created equal, and focusing on upgrades that offer the highest potential for increasing your home’s value is key.”

And remember, it’s not just big-ticket items that can have an impact. Your agent will also speak to some of the smaller details – like cleaning up your yard, adding fresh mulch, or painting your front door – to make a real difference in how buyers feel about your home. This type of expert eye is crucial to help your house sell fast and for top dollar.

Bottom Line

Thinking of selling your house next year? Don’t wait until the last minute to get it ready. By getting a head start now, you can ensure everything is in place by the time the new year rolls around.

Need advice on what to tackle first? Let’s connect. You can start with our Seller Information Page!