A recent survey found that more than half (52%) of American homeowners have a renovation project planned this year.1 If you’re among them, you know that embarking on home improvements can be both exciting and daunting. According to the survey, the median renovation budget is around $15,000, so you’re probably investing a significant amount—and you’ll want to ensure your project’s success.1 One of the most critical decisions you’ll make is choosing the right contractor to bring your vision to life. However, many homeowners fall into common pitfalls during this process, leading to stress, financial strain, and subpar results. In this post, we’ll explore 7 Mistakes to Avoid When Hiring a Contractor to ensure your project runs smoothly from start to finish.

A recent survey found that more than half (52%) of American homeowners have a renovation project planned this year.1 If you’re among them, you know that embarking on home improvements can be both exciting and daunting. According to the survey, the median renovation budget is around $15,000, so you’re probably investing a significant amount—and you’ll want to ensure your project’s success.1 One of the most critical decisions you’ll make is choosing the right contractor to bring your vision to life. However, many homeowners fall into common pitfalls during this process, leading to stress, financial strain, and subpar results. In this post, we’ll explore 7 Mistakes to Avoid When Hiring a Contractor to ensure your project runs smoothly from start to finish.1. SKIPPING THE RESEARCH PHASE

-

Educate Yourself — Read up or watch YouTube videos to gain a better understanding of best practices surrounding your project.

-

Interview Multiple Contractors — Search for and interview at least three contractors who specialize in the type of work you need.

-

Ask Specific Questions — Inquire about the processes and materials each candidate will utilize.

-

Seek Recommendations — Get referrals from trusted sources like friends, neighbors, and real estate professionals. We’d be happy to share a list of referrals!

2. CHOOSING BASED SOLELY ON PRICE

-

Consider Overall Value — In addition to price, look at experience, reputation, and quality of work.

-

Ask for Detailed Breakdowns — Understand what’s included and what’s not in each bid.

-

Be Wary of Low Bids – Bids that are significantly lower than others may be too good to be true.

-

Invest in Quality — Remember that quality work comes at a fair price, and investing in a reputable contractor can save you money in the long run by avoiding costly mistakes or repairs.

3. NEGLECTING TO CONFIRM CREDENTIALS & INSURANCE

When you’ve established a good rapport with a contractor, it’s natural to want to believe the best in them. But neglecting to check references and verify licensing and insurance could come back to haunt you.3 Hiring an untrained or unlicensed contractor puts you at risk for safety and code violations, not to mention shoddy workmanship. Without proper insurance, you could be left footing the bill for costly repairs, legal issues, or even medical bills if someone gets hurt on the job.4 Skipping out on a reference check can be equally problematic. It’s your best opportunity to ensure that their promises and your expectations line up with reality. What To Do Instead:

When you’ve established a good rapport with a contractor, it’s natural to want to believe the best in them. But neglecting to check references and verify licensing and insurance could come back to haunt you.3 Hiring an untrained or unlicensed contractor puts you at risk for safety and code violations, not to mention shoddy workmanship. Without proper insurance, you could be left footing the bill for costly repairs, legal issues, or even medical bills if someone gets hurt on the job.4 Skipping out on a reference check can be equally problematic. It’s your best opportunity to ensure that their promises and your expectations line up with reality. What To Do Instead:-

Verify Licensing and Insurance — Confirm that the contractor is licensed according to local requirements and verify insurance, including general liability and workers’ compensation coverage.

-

Check Reviews — Read online reviews and confirm that the business is in good standing with the Better Business Bureau and other relevant trade groups.

-

Call References — When contacting references, ask questions and request to see photos of the contractor’s completed projects.

-

Visit Job Sites — If possible, visit a current job site to observe the contractor’s work in progress and interaction with clients.

4. PROCEEDING WITHOUT A WRITTEN AGREEMENT

-

Insist on a Written Contract — Outline all aspects, including scope, materials, timeline, payment schedule, warranty information, and a process for handling change orders.

-

Understand and Agree — Don’t sign anything until you fully understand and agree to all terms.

-

Keep Documentation — Once you’ve made your final payment, request a lien waiver or receipt marked “Paid in Full” to keep on file for legal and tax purposes.6

5. PAYING TOO MUCH UPFRONT

Another common misstep is paying a large sum upfront or the full cost of the project before the work is completed. This can leave you vulnerable if the contractor fails to complete the work or disappears with your money. According to the home services platform Angi, deposits typically range between 10% and 33% of the total project cost.7 The remaining payments should be tied to progress milestones outlined in your contract. Construction attorneys caution against paying a greater share of the project cost than the percentage of the work that’s been completed.3 If you end up dissatisfied with the outcome, you’ll have much less leverage if you’ve already paid. What To Do Instead:

Another common misstep is paying a large sum upfront or the full cost of the project before the work is completed. This can leave you vulnerable if the contractor fails to complete the work or disappears with your money. According to the home services platform Angi, deposits typically range between 10% and 33% of the total project cost.7 The remaining payments should be tied to progress milestones outlined in your contract. Construction attorneys caution against paying a greater share of the project cost than the percentage of the work that’s been completed.3 If you end up dissatisfied with the outcome, you’ll have much less leverage if you’ve already paid. What To Do Instead:-

Be Cautious — Avoid contractors who demand large upfront payments or cash-only deals.

-

Establish a Payment Schedule — Tie payments to project milestones and stick to them.

-

Pay Only Upon Completion — Never pay in full until the project is completed to your satisfaction and all required inspections have been passed.

6. FAILING TO GET NECESSARY PERMITS

-

Discuss Permits — Talk about permits and HOA requirements with your contractor before work begins.

-

Include Permits in the Contract — Ensure that obtaining necessary permits and approvals is part of your contract.

-

Verify Inspections — Make sure all required inspections are completed during the project.

-

Keep Records — Keep copies of all permits, HOA approvals, and inspection reports for your records.

7. IGNORING RED FLAGS AFTER THE PROJECT HAS STARTED

-

Review Your Contract — Make sure you thoroughly understand your rights and the agreed-upon terms.

-

Document Issues — Keep detailed records, including dates, descriptions of problems, photographs of subpar work or materials, and any communications with the contractor.

-

Communicate Professionally — Arrange a meeting to discuss your concerns, ensuring you remain calm and professional while clearly expressing your expectations.

-

Request a Resolution Plan — Ask for a plan to address the issues, set a timeline for resolution, and put everything in writing to ensure you’re both on the same page.

-

Seek Advice — If the contractor is uncooperative or dismissive, consider seeking advice from a legal professional. You could also contact your local licensing board or consumer protection agency for guidance.

BOTTOMLINE

-

National Association of the Remodeling Industry – https://remodelingdoneright.nari.org/Homeowner-Resources/Questions-to-ask/How-to-select-a-remodeler

-

The Washington Post – https://www.washingtonpost.com/home/2024/07/08/how-to-find-good-honest-contractor/

-

Better Business Bureau – https://www.bbb.org/all/home-improvement/your-home-improvement-contract

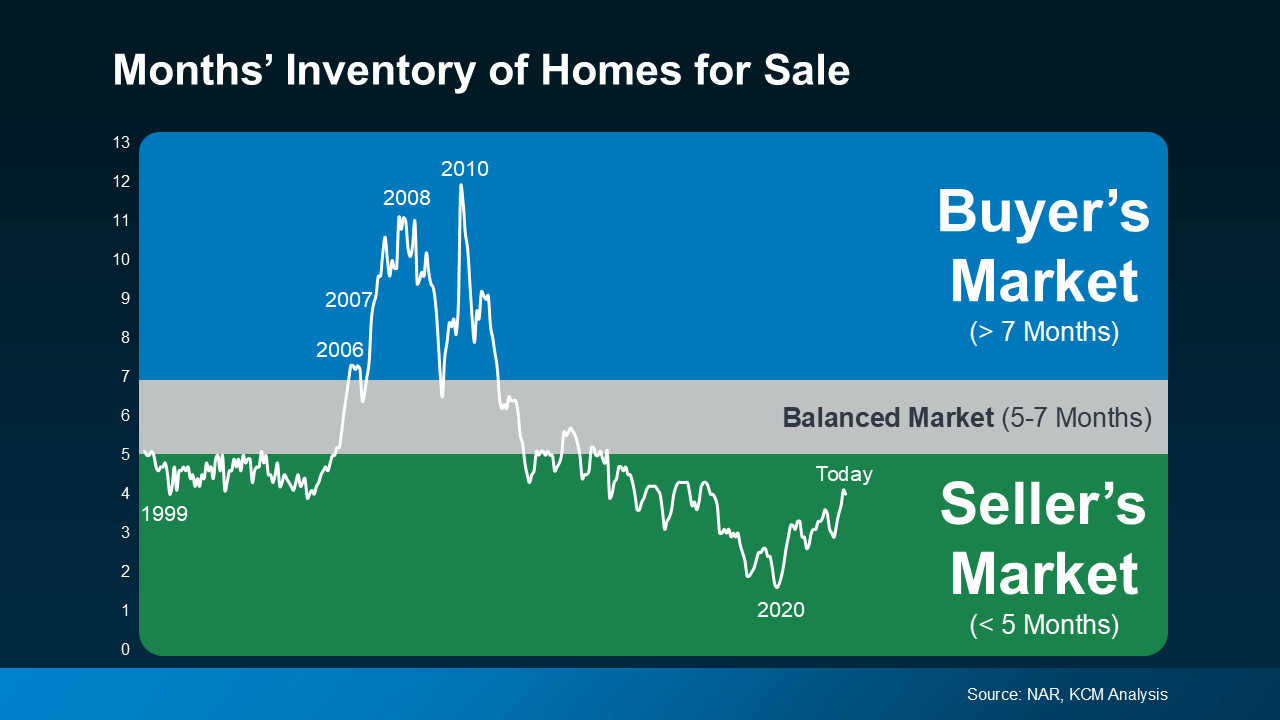

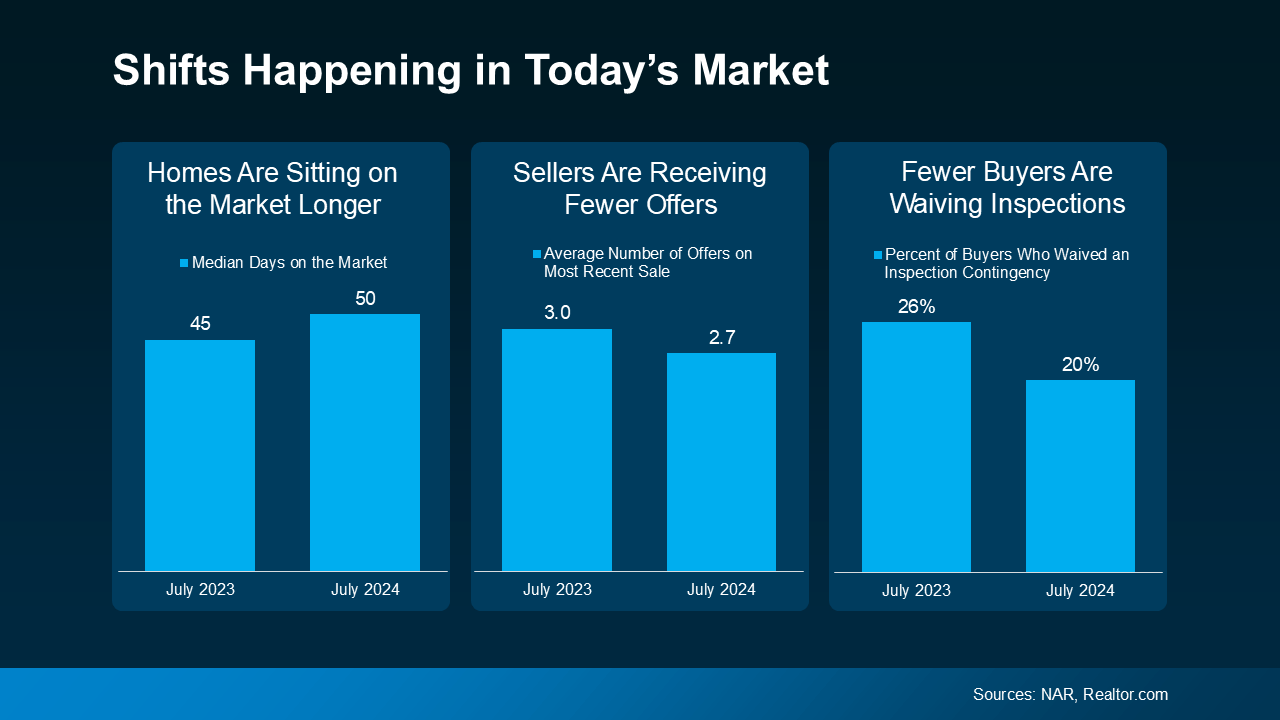

Homes Are Sitting on the Market Longer: Since more homes are on the market, they’re not selling quite as fast. For buyers, this means you may have more time to find the right home. For sellers, it’s important to

Homes Are Sitting on the Market Longer: Since more homes are on the market, they’re not selling quite as fast. For buyers, this means you may have more time to find the right home. For sellers, it’s important to